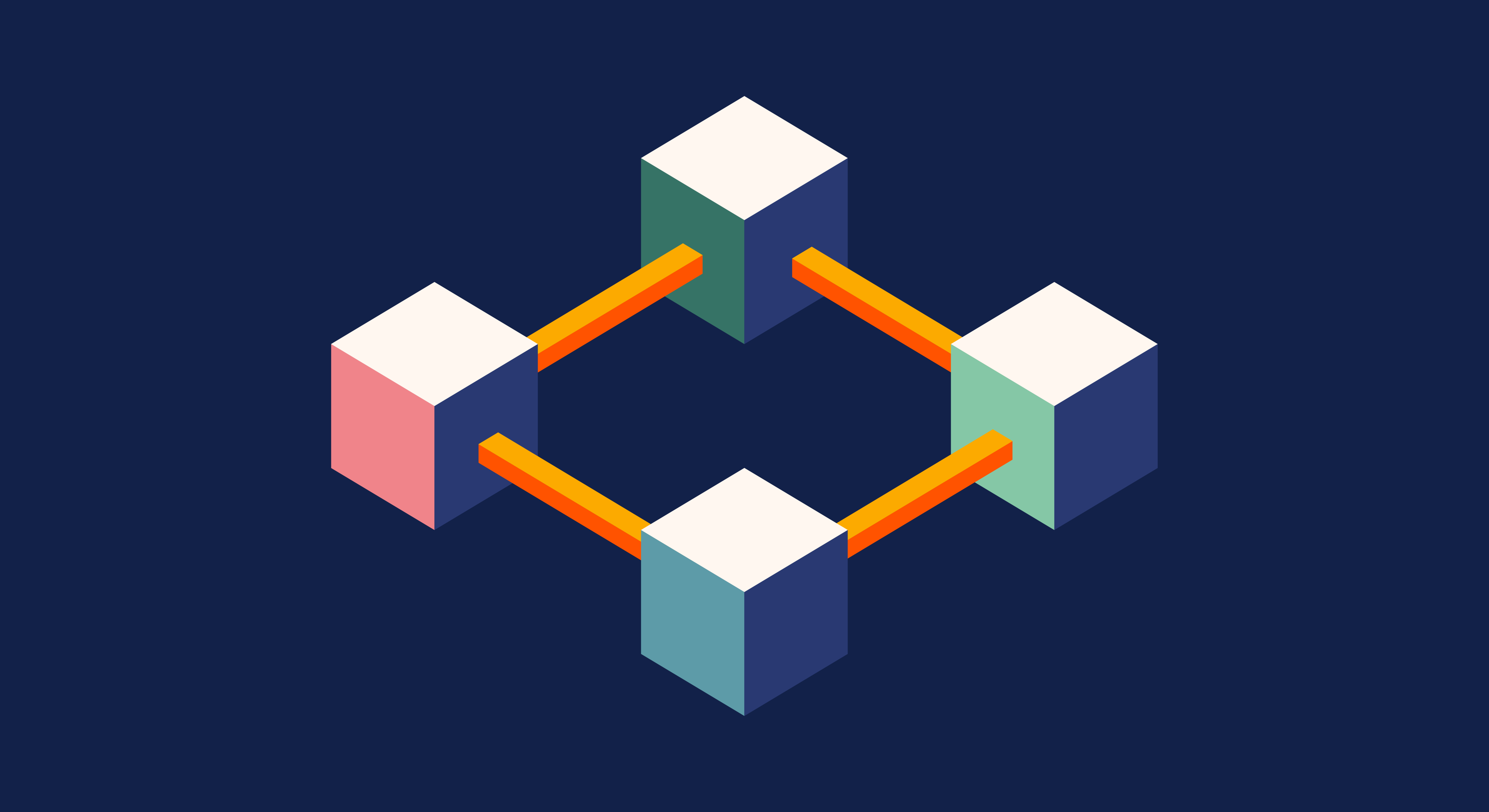

Mining is the process that Bitcoin and several other cryptocurrencies use to generate new coins and verify new transactions. It involves vast, decentralized networks of computers around the world that verify and secure blockchains – the virtual ledgers that document cryptocurrency transactions. In return for contributing their processing power, computers on the network are rewarded with new coins. It’s a virtuous circle: the miners maintain and secure the blockchain, the blockchain awards the coins, the coins provide an incentive for the miners to maintain the blockchain.

How does mining work?

There are three primary ways of obtaining bitcoin and other cryptocurrencies. You can buy them on an exchange like Coinbase, receive them as payment for goods or services, or virtually “mine” them. It’s the third category that we’re explaining here, using Bitcoin as our example.

You might have considered trying bitcoin mining yourself. A decade ago, anyone with a decent home computer could participate. But as the blockchain has grown, the computational power required to maintain it has increased. (By a lot: In October 2019, it required 12 trillion times more computing power to mine one bitcoin than it did when the first first blocks were mined in January 2009.) As a result, amateur bitcoin mining is unlikely to be profitable for hobbyists these days. Virtually all mining is now done by specialized companies or groups of people who band their resources together. But it’s still good to know how it works.

-

Specialized computers perform the calculations required to verify and record every new bitcoin transaction and ensure that the blockchain is secure. Verifying the blockchain requires a vast amount of computing power, which is voluntarily contributed by miners.

-

Bitcoin mining is a lot like running a big data center. Companies purchase the mining hardware and pay for the electricity required to keep it running (and cool). For this to be profitable, the value of the earned coins has to be higher than the cost to mine those coins.

-

What motivates miners? The network holds a lottery. Every computer on the network races to be the first to guess a 64-digit hexadecimal number known as a “hash.” The faster a computer can spit out guesses, the more likely the miner is to earn the reward.

-

The winner updates the blockchain ledger with all the newly verified transactions – thereby adding a newly verified “block” containing all of those transactions to the chain – and is granted a predetermined amount of newly minted bitcoin. (On average, this happens every ten minutes.) As of late 2020, the reward was 6.25 bitcoin – but it will be reduced by half in 2024, and every four years after. In fact, as the difficulty of mining increases, the reward will keep decreasing until there are no more bitcoin left to be mined.

-

There will only ever be 21 million bitcoin. The final block should theoretically be mined in 2140. From that point forward, miners will no longer rely on newly issued bitcoin as reward, but instead will rely on the fees they charge for making transactions.

Why is mining important?

Beyond releasing new coins into circulation, mining is central to Bitcoin’s (and many other cryptocurrencies’) security. It verifies and secures the blockchain, which allows cryptocurrencies to function as a peer-to-peer decentralized network without any need for oversight from a third party. And it creates the incentive for miners to contribute their computing power to the network.