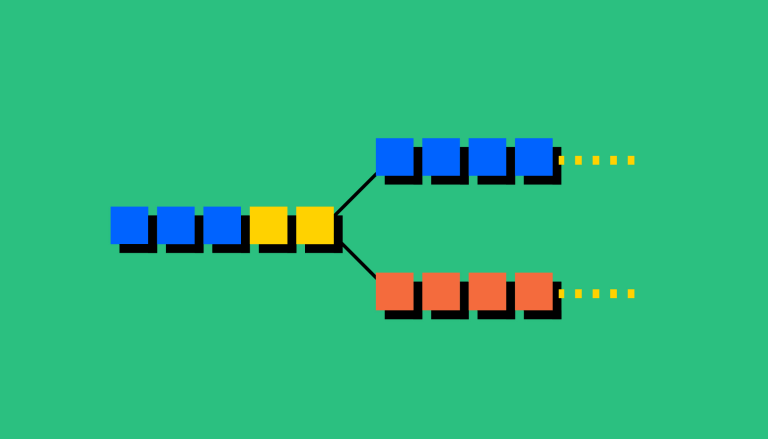

Cryptocurrencies like Bitcoin and Ethereum are powered by decentralized, open software that anyone can contribute to called a blockchain. They’re called blockchains because they’re literally made up of blocks of data – picture a really long train – that can be traced all the way back to the first-ever transaction on the network. And because they are open source, they rely on their communities to maintain and develop their underlying code.

A fork happens whenever a community makes a change to the blockchain’s protocol or basic set of rules. When this happens, the chain splits — producing a second blockchain that shares all of its histories with the original, but is headed off in a new direction.

Why is this important?

Most digital currencies have independent development teams responsible for changes and improvements to the network, much in the same way that changes to internet protocols allow web browsing to become better over time. So sometimes a fork happens to make a cryptocurrency more secure or add other features.

But it’s also possible for the developers of a new cryptocurrency to use a fork to create entire new coins and ecosystems.

-

Soft fork: Think of a soft fork as a software upgrade for the blockchain. As long as it’s adopted by all users, it becomes a currency’s new set of standards. Soft forks have been used to bring new features or functions, typically at the programming level, to both Bitcoin and Ethereum. Because the end result is a single blockchain, the changes are backward-compatible with the pre-fork blocks.

-

Hard fork: A hard fork happens when the code changes so much the new version is no longer backward-compatible with earlier blocks. In this scenario, the blockchain splits in two: the original blockchain and the new version that follows the new set of rules. This creates an entirely new cryptocurrency – and is the source of many well-known coins. Cryptocurrencies like Bitcoin Cash and Bitcoin Gold evolved out of the original Bitcoin blockchain via a hard fork.

Why do forks occur?

Just like all software needs upgrades, blockchains are updated for a variety of reasons:

-

To add functionality

-

To address security risks

-

To resolve a disagreement within the community about the cryptocurrency’s direction

How are forks continuing to change the crypto landscape?

-

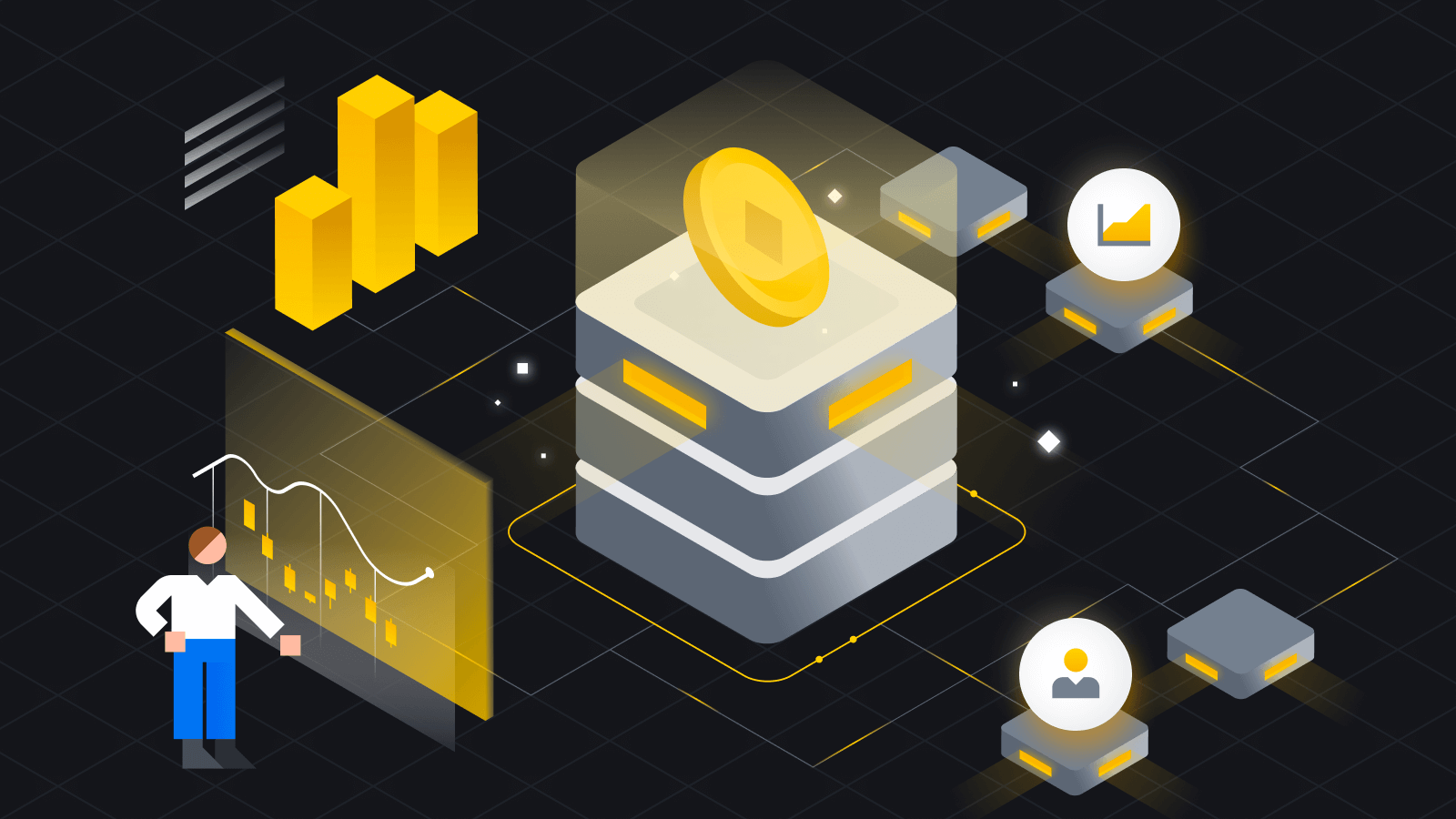

The Ethereum blockchain is designed to run “smart contracts,” which are chunks of code that automatically execute a set of predetermined actions when certain criteria are met. Smart contract applications include everything from games to logistics tools to Defi apps.

-

As the platform that runs all these applications, you can think of the Ethereum blockchain as similar to a computer’s operating system. In that analogy, the various Ethereum forks – Ethereum, Ethereum Classic, Ethereum 2.0 – are like newer versions of an operating system that add features or efficiencies the prior versions might have lacked.

-

An older fork might continue as a stable, well-proven platform while a newer fork might offer developers entirely novel ways of interacting with it. (Older and newer versions can eventually merge or continue evolving further apart.)

-

Think of a soft fork as a ‘software upgrade’ (like when your phone asks you to update to the latest OS) and a hard fork as an entirely new operating system (like Linux and Mac OS are evolutions of the half-century-old UNIX platform).