There are a lot of methods you can use to research an asset you’re interested in trading. But two of the major strategies investors use are called technical analysis and fundamental analysis.

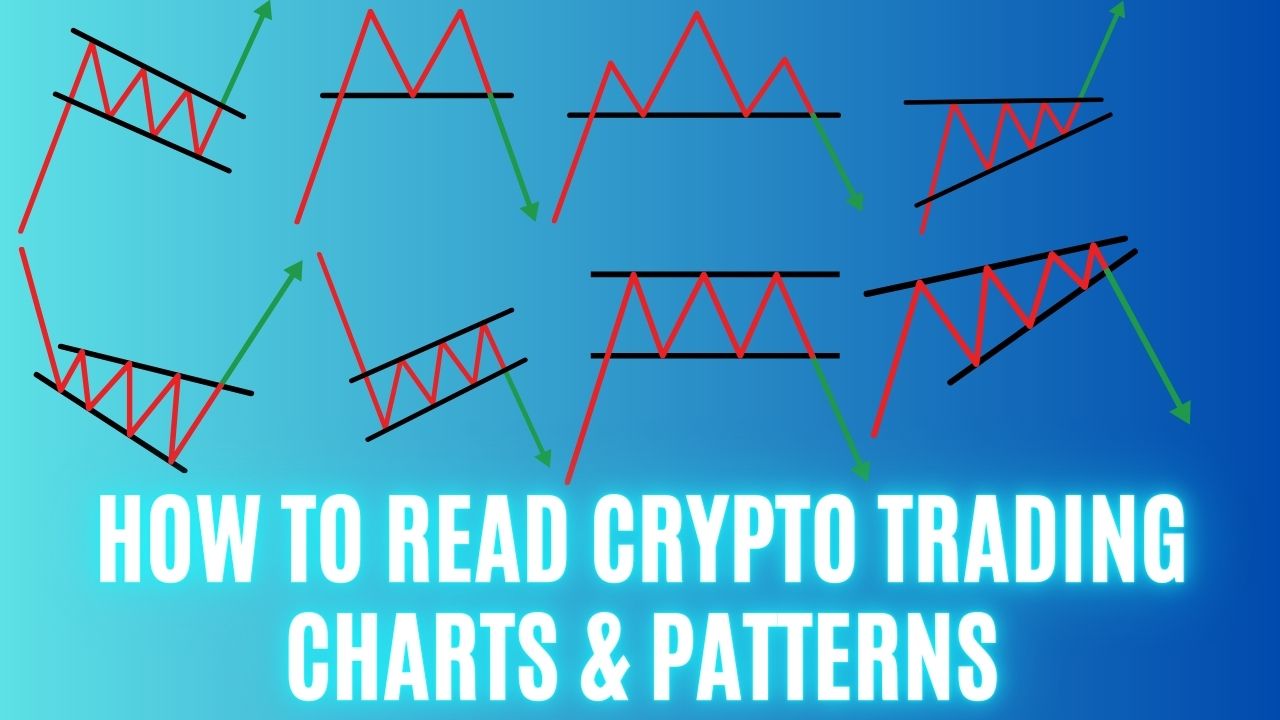

Technical analysis focuses on an asset’s historical market performance: by examining price over time and trading volume over time, you can get a sense of how the market sees the asset. Is it rising or falling? Are people putting money in or taking it out? Is it traded widely and in large quantities? Those are the kinds of questions that technical analysis asks.

Fundamental analysis, on the other hand, involves looking at an asset’s “fundamentals” — it’s more of a big-picture approach. It incorporates information like a cryptocurrency’s financials, user community, and potential real-world applications.

Both are valuable ways of understanding investment and can be applied to everything from stocks and bonds to, of course, cryptocurrency. And they can both help you build a trading strategy and identify when you want to buy or sell a particular asset.

How does fundamental analysis work?

With fundamental analysis you can decide if an asset is overpriced or underpriced based on how you see its intrinsic value — as in, will it be more useful in the future? Take, for instance, Ethereum. Most decentralized finance (or DeFi) applications run on their blockchain. If you assume DeFi will grow, you might guess that Ethereum’s value will increase in the future.

How does technical analysis work?

-

Technical analysis is more of a numbers-driven approach to decision-making. It assumes that the market has already done the work of incorporating all the known information via the current price (which you can find in the Coinbase app or many other places online) and amount of trading activity (look to crypto-data sites like Nomics and CoinGecko).

-

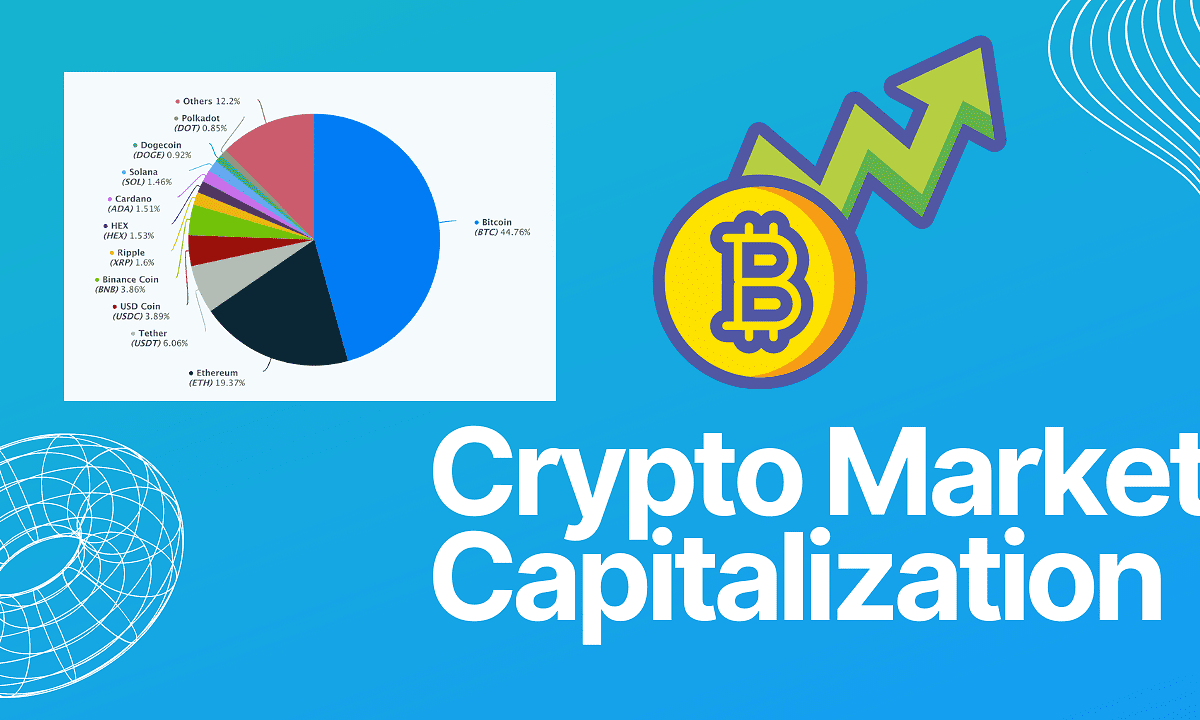

Because current prices reflect market forces like supply and demand, practitioners of technical analysis believe that the price of an asset should give you a snapshot of how the public feels about it right now. This is known as market sentiment, and it’s indicator traders use to predict trends and make investment decisions.

Why are they important?

Unless you have access to high-level models and tools that pro traders use, using both strategies together can provide a fuller view of your trades. While fundamental analysis looks at the more objective indicators for an asset’s potential long-term value – things like network activity, use case, business model, and roadmap — technical analysis focuses specifically on an asset’s market performance.

Professional traders, on the other hand, might rely much more on one or the other. (Large, mature markets tend to have lots of traders of both types.) A trader might, for instance, perform technical analysis using computer models that deeply examine changes in price and volume – including regressions, the relative strength index, and stock-market data. If a given asset tends to go through fairly regular boom-and-bust cycles, technical analysis can give investors insight into the rhythm of these cycles, helping them see opportunities to capitalize on these short-term cycles.

Keep in mind that…

-

Executing successful short-term investment strategies is notoriously difficult. History doesn’t repeat itself, so studying price patterns won’t necessarily help you make strong predictions, especially in volatile markets.

-

You should invest only what you can afford. A financial advisor can help you develop a strategy and understand the risks associated with investing in cryptocurrencies.

Disclosure

Coinbase offers simple and advanced trading. Advanced trading is for experienced traders and is subject to the Trading Rules. Fees on the two platforms vary. Content is for informational purposes and is not investment advice. Investing in crypto comes with risk.