Uniswap was one of the first decentralized finance (or DeFi) applications to gain significant traction on Ethereum — launching in November 2018. Since then, numerous other decentralized exchanges have been launched (including Curve, SushiSwap, and Balancer), but Uniswap is currently the most popular by a significant margin. As of April 2021, Uniswap had processed over $10 billion in weekly trading volume.

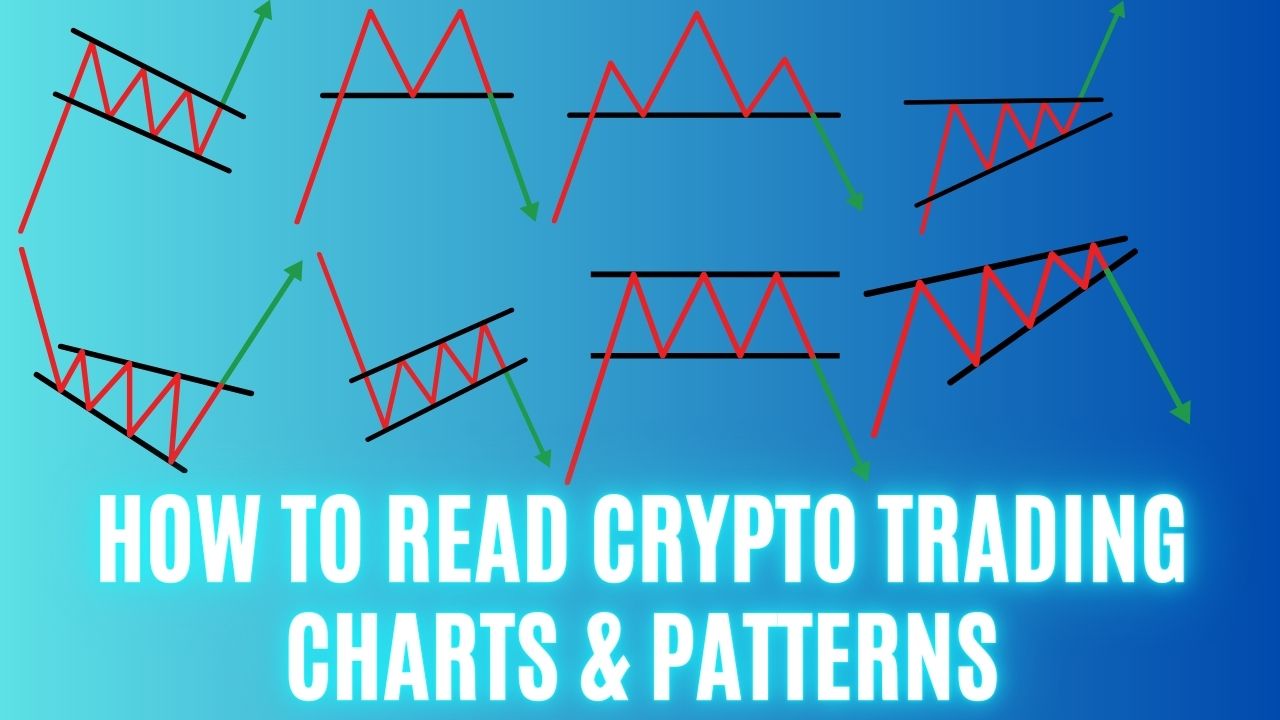

Uniswap pioneered the Automated Market Maker model, in which users supply Ethereum tokens to Uniswap “liquidity pools” and algorithms set market prices (as opposed to ordering books, which match bids and asks on a centralized exchange like Coinbase) based on supply and demand.

By supplying tokens to Uniswap liquidity pools, users can earn rewards while enabling peer-to-peer trading. Anyone, anywhere, can supply tokens to liquidity pools, trade tokens, or even create and list their own tokens (using Ethereum’s ERC-20 protocol). There are currently hundreds of tokens available on Uniswap, and some of the most popular trading pairs are stablecoins like USDC and Wrapped Bitcoin (WBTC).

Some of the potential advantages of decentralized exchanges like Uniswap include:

- Safe: Funds are never transferred to any third party or are generally subject to counterparty risk (i.e. trusting your assets with a custodian) because both parties are trading directly from their own wallets.

- Global and permissionless: There is no concept of borders or restrictions on who can trade. Anyone with a smartphone and an internet connection can participate.

- Ease of use and pseudonymous: No account signup or personal details are required.

How to use Uniswap

In order to use Uniswap, all you need is an Ethereum wallet, such as Coinbase Wallet, and a bit of ETH (which you’ll need to pay for gas fees). Using the app browser built into Coinbase Wallet’s mobile application or its desktop browser extension, you can access app.uniswap.org to start swapping tokens or supplying liquidity.

One issue users of all Ethereum-based apps including Uniswap face are transaction fees (also called gas) that can vary widely in price and can make it expensive to use the network. Multiple solutions to this issue are in the works, from the long-planned transition to the ETH2 blockchain (scheduled for sometime in 2022) to the nearer-term rollout of a “Layer 2” scaling solution called Optimism later this year. Uniswap developers are confident that Optimism will allow for significantly cheaper Uniswap transactions.

In early May 2021, Uniswap v3 launched with the goal of making transactions faster and cheaper.

What is UNI?

After years of successful operation and on its path to complete decentralization, Uniswap introduced the UNI token to enable community ownership over the protocol, allowing stakeholders to vote on key protocol changes and development initiatives. When Uniswap released the token in September 2020, it used a unique form of distribution in which it “airdropped” 400 UNI tokens to each Ethereum address that had ever used the protocol. Over 250,000 Ethereum addresses received the airdrop, which was worth nearly $1,400 at the time. Airdrops have since become a popular way for DeFi apps to reward longtime users – Uniswap has said it plans to distribute a total of 1 billion UNI over four years.

Why are there so many DEXs with “Swap” in the name?

It’s because Uniswap, like most crypto protocols, is open source, meaning anyone can both see exactly how it works and adapt the code to create a competitor.

In recent years, a large number of DEXs adapted from Uniswap’s code have launched, including food-named competitors like SushiSwap and PancakeSwap. (If you want to read more, check out this issue of Coinbase’s Around the Block newsletter.)