Whether you’re looking into cryptocurrency, stocks, real estate, or any other asset, you’ll often see markets described in one of two ways: a bull market or a bear market. To put it simply, a bull market is a rising market, while a bear market is a declining one. Because markets often experience day-to-day (or even moment-to-moment) volatility, both terms are generally reserved for:

-

Longer periods of mostly upward or downward movement

- Substantial upward or downward swings (20% is the widely accepted figure)

What is a bull market?

A bull market, or bull run, is defined as a period of time where the majority of investors are buying, demand outweighs supply, market confidence is at a high, and prices are rising. If in a given market, you see prices quickly trending upwards, this could be a sign that the majority of investors are becoming optimistic or “bullish” about the price increasing further, and may mean that you’re looking at the start of a bull market.

Investors who believe that prices will increase over time are known as “bulls.” As investor confidence rises, a positive feedback loop emerges, which tends to draw in further investment, causing prices to continue to rise.

Because the price of a given cryptocurrency is substantially influenced by public confidence in that asset, a strategy some investors use is to try to determine investors’ optimism in a given market (a measure known as “market sentiment”).

What marks the end of a bull market?

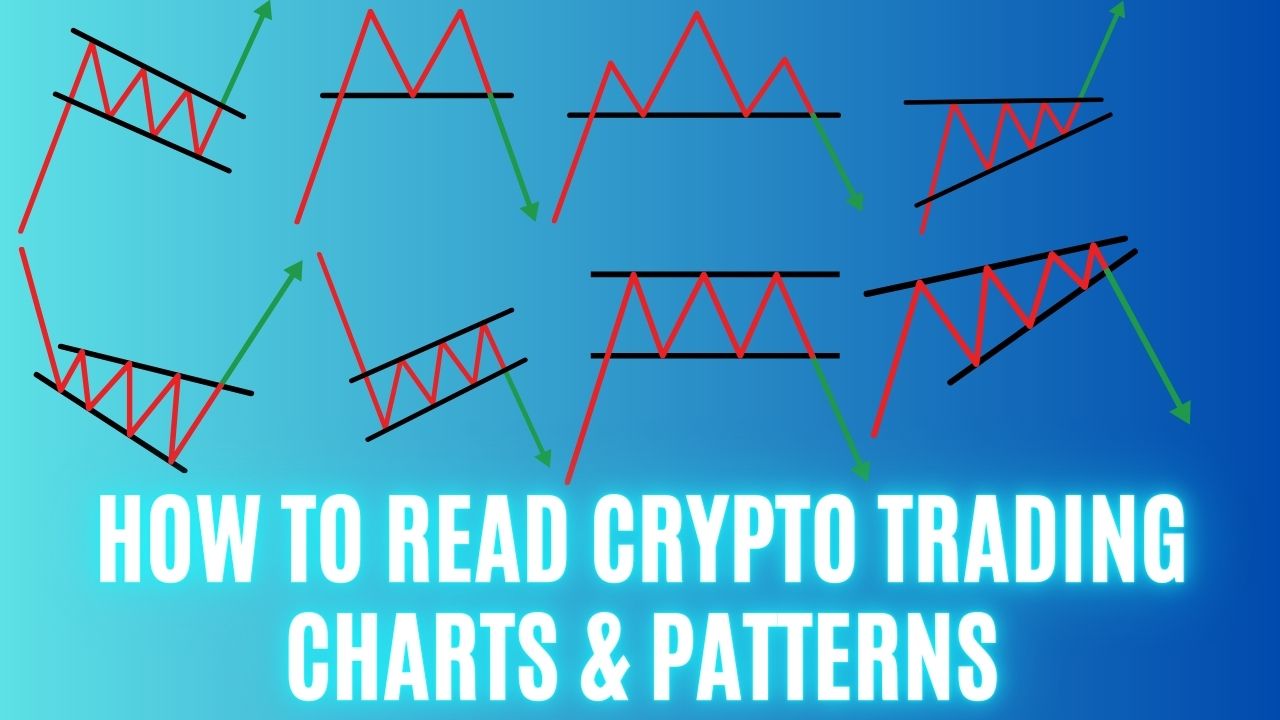

Even during a bull market, there will be fluctuations, dips, and corrections along the way. It can be easy to misinterpret short-term downward movements as the end of a bull market. This is why it’s important to consider any potential signs for a trend reversal from a broader perspective, looking at price action over longer time frames. (Investors with a shorter time-frame often talk about “buying the dip.”)

History has shown that bull markets don’t last forever, and at some point, investor confidence will begin to decline — this could be triggered by anything from bad news like unfavorable legislation to unforeseen circumstances like the COVID-19 pandemic. A sharp downwards price movement can begin a bear market, where more and more investors believe prices will continue to fall, causing a downward spiral as they sell in order to prevent further losses.

What is a bear market?

Bear markets are defined as a period of time where supply is greater than demand, confidence is low, and prices are falling. Pessimistic investors who believe prices will continue to fall are, therefore, referred to as “bears.” Bear markets can be difficult to trade in, particularly for inexperienced traders.

It’s notoriously difficult to predict when the bear market might end and when the bottom price has been reached — as rebounding is usually a slow and unpredictable process that can be influenced by many external factors such as economic growth, investor psychology, and world news or events.

But they also can present opportunities. After all, if your investment strategy is longer-term, buying during a bear market can pay off when the cycle reverses itself. Investors with shorter-term strategies can also be on the lookout for temporary price spikes or corrections. And for more advanced investors, there are strategies like short selling, which is a way of betting that an asset will decline in price. Another strategy many crypto investors employ is dollar-cost averaging, in which you’d invest a set amount of money (say $50) every week or month, whether the asset is rising or falling. This distributes your risk and allows you to invest through bull and bear markets alike.

Where did these “bull” and “bear” terms come from, anyway?

Like a lot of financial terms, the origins aren’t clear. But most people believe they derive from the way each animal attacks: bulls thrust their horns upward, while bears swipe downwards with their claws. There is of, course, a long history of theory and evidence around the origin of the terms. If you’re curious, this Merriam-Webster explainer is a good place to start.